US Bond Yields And Correlation To The Dollar

- Written by ACN Newswire - Press Releases

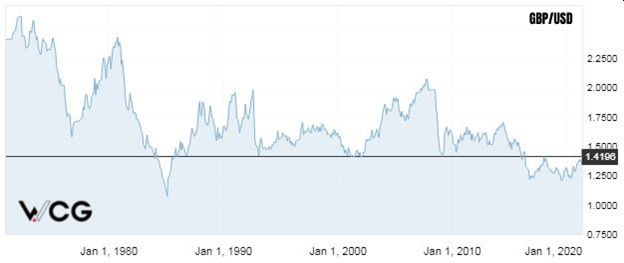

Jakarta, Indonesia, June 3, 2021 - (ACN Newswire) - The British Pound Sterling held firm near a three-month high against the US dollar last week, amid rising expectations of an earlier than expected rate hike by the Bank of England, while the US currency looks to inflation data which will come. The British pound was up at $1.4203 after rising 0.58% on Thursday after Bank of England policy makers said the central bank is likely to raise interest rates through next year. The euro was at $1.2190, below a 5 1/2-month high touched Tuesday at $1.2266 as steady comments from European Central Bank officials dampened its momentum ahead of a policy meeting on June 10. The dollar jumped to 109.85 yen, breaking its limited range for the past few weeks, to hit its highest level in seven weeks. The jump likely reflects yen selling due to MSCI's overhaul of its standard stock index, from which nearly 30 Japanese names were stripped, analysts said.

The yen was also hampered by concerns about a delay in Japan's economic recovery after media reported that Japan wanted to extend the state of emergency in Tokyo and several other areas in the three weeks to June 20. Additionally, the Dollar enjoyed a slight boost from higher US bond yields following a New York Times report that President Joe Biden will announce on Friday a $6 trillion budget for 2022. The proposal comes as the US economic recovery appears to be gaining momentum. The number of Americans filing new claims for unemployment benefits fell more than expected last week to a seasonally adjusted 406,000 as companies desperately need workers to meet soaring demand as the economy reopens quickly. US inflation data due at 1230 GMT on Friday is one of the biggest focuses, as a high yield could fuel expectations of policy tightening by the Federal Reserve. Analysts at WCG Markets expect core PCE prices (personal consumption expenses) to jump 2.9% year-on-year in April, compared to a year-on-year increase of 1.8% in the previous month. While that is well above the Federal Reserve's 2% target, economists expect core inflation to slow gradually later in the year, allowing the Fed to stick to its current asset-buying measure for now.

Media contactCompany: WCG MarketsContact: BrianEmail: ops@wcglb.comWebsite:https://www.wcglb.com/

Copyright 2021 ACN Newswire. All rights reserved. www.acnnewswire.com

Authors: ACN Newswire - Press Releases

Read more //?#