Indonesia is set to become the hub for Chinese vaccines in Southeast Asia. How does the country benefit?

- Written by Anda Nugroho

Getting a vaccine has become the ultimate escape route from the pandemic with more than a million lives lost and billions more at risk from coronavirus.

Countries are willing to spend billions of dollars to obtain the COVID-19 vaccine, which is highly promising for the vaccine industry in coming years.

Indonesia’s opportunity to become a centre of the COVID-19 vaccine industry is wide open with an offer from China to make Southeast Asia’s largest economy the hub for the production and distribution of Chinese vaccines in the region.

Chinese Foreign Minister Wang Yi said his country was willing to work with Indonesia to “promote the research and development, production and use of the vaccine […] in the region and even the world”.

Get high quality analyses on Indonesia and Southeast Asia from the experts

So far Indonesia has become a testing ground for a vaccine being developed by China’s Sinovac Biotech Ltd. Sinovac will also co-operate with Indonesian pharmaceutical holding company Bio Farma to produce the COVID-19 vaccines.

This opportunity will not only give Indonesia the benefit of securing first access to the vaccines but also enable the country to cash in on the profits from vaccine production and distribution.

Gaining economic benefits

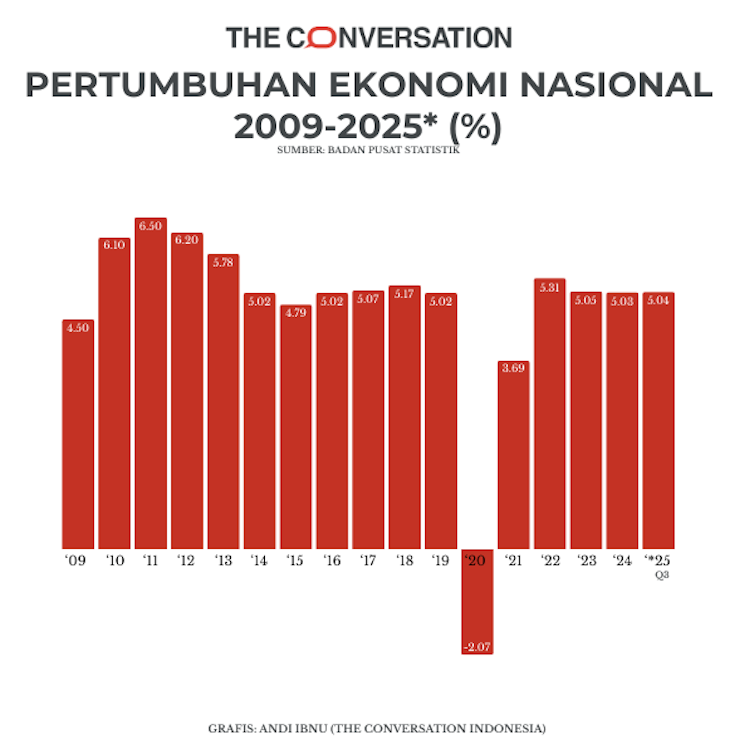

Having first access to COVID-19 vaccines could help Indonesia’s stalled economy, which has stalled during the pandemic. The country is set to enter a recession marked by two consecutive quarters of negative economic growth.

Indonesian Finance Minister Sri Mulyani Indrawati has forecast the economy might dip to minus 2.9% in the third quarter of this year after contracting by 5.32% in the second quarter.

If people are vaccinated against the virus, economic activity can be restored and the economy would recover. The potential global income boost from coronavirus vaccines is up to US$9 trillion by 2025. For Indonesia, it is estimated a half-year delay in the delivery of COVID-19 vaccines will result in a massive economic loss of US$44 billion.

Not only does it save the Indonesian people as well the economy, if Indonesia can maximise its role as the hub of COVID-19 vaccines for Southeast Asia, the country may gain a share of the profits.

With a total population of 670 million, Southeast Asia is undoubtedly an attractive market. The value of the region’s total vaccine imports was US$223 million in 2010 and almost quadrupled to US$859 million in 2019.

World Bank trade statistics show Indonesia is the biggest vaccine exporter in Southeast Asia. The country earned US$76.3 million from vaccine exports in 2010, which grew by 25.2% to US$95.5 million in 2019. Singapore and Thailand followed Indonesia with a combined export value of US$80.7 million in 2019.

The vaccine industry may also create new employment opportunities. Indonesia’s annual manufacturing survey shows the vaccine industry created more than 1,500 jobs in 2018. The expansion of the industry will likely bring in more new jobs.

That figure is relatively small compared to the 3.5 million jobs lost during the pandemic. Yet the vaccine industry may bring other economic benefits.

Under the agreement with China, Indonesia becomes not only the main distributor of Chinese vaccines for the region but also the producer. This means Indonesia will save money on vaccine imports.

If the country wants to achieve herd immunity and stop the pandemic, it must vaccinate at least 50% of its population. Sinovac’s vaccine price is tagged at US$60 for its full double dose. Therefore, the country needs to spend at least US$8.2 billion to vaccinate 50% of the population of 273.5 million. This amount is equal to more than twice our trade deficit last year of US$3.2 billion.

The number is just an estimate. The real total cost might be higher, depending on the vaccine’s efficacy and the type of the vaccine (single or two-dose vaccine). If the vaccine is less effective, the number of people who need to be vaccinated will be higher than 50% to be able to achieve herd immunity. If a dual-dose vaccine is needed, the number of vaccines that has to be produced would double.

Reducing imports by producing COVID-19 vaccines locally will also help our trade balance. Indonesia is set to produce 250 million doses of vaccines by December. The production involves Sinovac as the vaccine provider, while Indonesia’s Bio Farma will be responsible for vaccine packaging.

If Indonesia could sell its locally value-added COVID-19 vaccines to other Southeast Asian countries, it would generate income for the country.

The challenges

Although it promises many benefits, there is an enormous challenge to be overcome before Indonesia can benefit from becoming Southeast Asia’s vaccine hub.

First is the mismatch between domestic production capacity and regional needs.

Bio Farma has a production capacity of 100 million vaccine doses a year. The firm is investing US$88.6 million to increase production capacity to 250 million doses a year in 2021. Considering each person will need at least two doses, its annual vaccine production would be only enough for 125 million people.

Even with the upgraded capacity, it would still take years to supply Southeast Asia’s or even domestic needs. However, as the need for vaccines is urgent, production capacity may soon be increased further. It is predicted the capacity to produce COVID-19 vaccines won’t be sufficient until 2024.

The next challenge is to increase the proportion of domestic content in COVID-19 vaccine production. Indonesia is only contributing to the packaging process, which is of relatively small value. In the future, Indonesia is expected to develop its own vaccines and the country should benefit from co-operation with China to enable knowledge and technology transfers from China to Indonesia.

With a supportive business environment and backing from China, the pandemic could be a blessing in disguise for Indonesia’s vaccine industry to tap into the regional market.

This article first appeared in The Conversation. It is republished with permission.